Big cities usually have apartment shortages. This is nothing new. But, nowadays, the prospective tenants come from a different demographic. Many of them are former (attempted) home buyers who couldn’t hold on. Some are people who, in a better economy, would be perfectly capable of buying a home, if they found work in the field they were trained for instead of washing cars or collecting unemployment. (And some have listened to Rich Dad, Poor Dad author Robert Kiyosaki, who says, “Your home is not an asset.”)

Ben Markus of Colorado Public Radio discusses recent events in Denver, and starts by talking about his visit with a couple renting a two-bedroom apartment for more than $900 per month. Before getting into that, here is some background. The page called “Living Wage Calculation for Denver County, Colorado,” explains that:

The living wage shown is the hourly rate that an individual must earn to support their family, if they are the sole provider and are working full-time (2080 hours per year).

They figure a typical two-adult household spends $692 a month on housing. But, in order to do that, each one of them has to be making at least $8.64 per hour. The minimum wage is $7.25 per hour. This means that a pair of minimum-wage workers would be hard-pressed to afford a $692 apartment, which probably has only one bedroom anyway, and certainly would not be able to afford the two-bedroom that goes for $900.

A family with two adults and two children needs $27.00 per hour coming in. But even if both adults are working, if they’re working for a minimum wage, there is less than $15 per hour coming in. That’s a pretty big discrepancy.

A fiscally prudent person doesn’t budget more than a quarter of their income for housing — that’s what they used to teach in home economics classes. Then somebody sneakily raised the bar. Now we are told, it’s wise not to spend more than one-third of the income on housing. And we’re supposed to feel just as prudent. (But one-third is more than one-fourth.)

Getting back to Markus, he next speaks with David Zucker, a land developer who is putting up a building different from the building originally planned for the spot, near Denver’s downtown. Markus says:

This project was originally planned as condos. But when the housing market collapsed, Zucker went back to the drawing board. Eventually, his financers looked at all the renters entering the market, and they liked his new idea of retooling the project from 60 condos to more than 200 apartments… Now, more than a dozen apartment buildings are going up in the Denver metro area, and dozens more are planned.

Then, he quotes economist Patrick Newport, who says:

We’re going to see more renting, less homeownership. And the recovery that we see in the housing market is going to be one that’s characterized more by more apartment construction, and less by single-family construction.

Markus also quotes investment broker Greg Benjamin, who says that financing is available for these projects now because demand exceeds supply, “allowing landlords to charge higher rents.” Well, of course, builders are getting into this apartment trend because they anticipate charging high rents. What they don’t seem to take into account is that there may not be many tenants who can pay high rents. But they don’t seem interested in creating low-rent housing.

Still, it’s possible that many existing renters will upgrade their lifestyles, leaving behind, and available, the older, less desirable apartments. Such units might even be affordable to the working poor. At any rate, although the increased number of apartments is good news, it’s only half the equation, the half that comes from the top. We also need the other half of the equation, the one that comes from the bottom. What we need is the Universal Living Wage – ULW (National Locality Wage – NLW), to put well-deserved adequate pay into the hands of people who want to rent those properties.

About the effect of a minimum wage hike, blogger Kasey Steinbrinck says:

Studies show that people at the lower end of earning tend to put the money right back into the economy. They get their car fixed, pay for needed home repairs, buy new clothes and spend money at many local businesses.

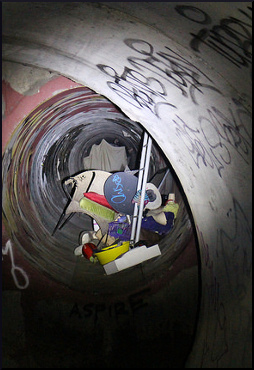

And spend it on apartment rent, if they get half a chance. A lot of people would like to move out of their vans, or off their mother’s couches, and find places of their own.

Steinbrinck also says this about minimum-wage workers:

When adjusted for inflation, the real value of their compensation actually fell by 5% since the federal minimum wage was last raised in 2009 to $7.25 an hour. If the minimum wage had kept pace with inflation over the past 40 years it would be almost $10.40 an hour… The Economic Policy Institute estimates that that raising the minimum wage to $9.50 would result in more than $60 billion in consumer spending. Now that’s a pretty nice economic stimulus!

But, of course, we have all traveled and know that the cost of living (the cost of housing) is not the same in Cleveland, Ohio, as it is in Santa Cruz, California, or in Washington, D.C., etc. In fact, we are a nation of 1,000 economies, each with its own cost of living. That is what the Universal Living Wage will address. It will ensure that a person working 40 hours in a week will be able to afford the basics: food, clothing, shelter (utilities included), wherever that work is done throughout the United States.

And the other wonderful aspect of the Universal Living Wage – ULW (National Locality Wage – NLW) is that it will stimulate the housing construction industry all across America and create jobs as we put the difference between the Federal Minimum Wage and the Universal Living Wage into the pockets of millions of working poor who all need the same thing: truly affordable housing. Finally, this will happen over a 10-year period in order to accommodate the business community. In this fashion, we can end homelessness for over 1,000,000 minimum-wage workers. Wow!

Reactions?

Source: “Demand For Denver Apartments Outstrips Supply,” NPR.org, 11/29/11

Source: “Living Wage Calculation for Denver County, Colorado,” Living Wage Calculator

Source: “Boosting Minimum Wage to Boost the Economy,” The Check Advantage Blog, 07/25/11

Homeless hole

Photo credit: Aydun via VisualHunt.com / CC BY